Every September, the world stops to watch Apple set the rhythm for the smartphone industry. If smartphones were symphonies, the iPhone would be the orchestra that keeps rewriting the notes—always a blend of familiarity and surprise.

With the iPhone 17 now in the spotlight, it’s not just another product release—it’s a milestone in Apple’s decades-long journey of balancing luxury and accessibility. And just like our viral Pixel breakdown, this post will unpack Apple’s story with hard stats, sales data, feature trends, user perceptions, and market impact—all in one place.

iPhone 13 to iPhone 17: Evolution in Features and Sales

Apple’s last five generations showcase a clear pattern of innovation: AI integration, design refinement, and pushing ecosystem boundaries.

Sales & Feature Impact Chart (2021–2025)

Year | Model | Key Features | Est. Sales (Year 1) | Market Impact |

|---|---|---|---|---|

2021 | iPhone 13 | Cinematic Mode, A15 Bionic | 90M+ | Boosted Apple’s video creator base |

2022 | iPhone 14 | eSIM (US), SOS via Satellite | 92M | First big leap in safety features |

2023 | iPhone 15 | USB-C, Dynamic Island for all | 95M | Compliance-driven but fan-approved |

2024 | iPhone 16 | AI features, Periscope zoom | 98M | AI as USP, strong camera hype |

2025 | iPhone 17 | Apple Intelligence 2.0, thinner build | 100M+ (proj.) | Redefining AI + design leadership |

👉 Aha stat: The iPhone 17 is projected to be Apple’s first iPhone to cross 100M units in its first year, beating its own iPhone 6 record from 2014.

The SE Series: Apple’s Affordable Genius

Apple’s iPhone SE series has been its gateway drug to the ecosystem, especially in price-sensitive markets.

Adoption Curve of SE Models vs. Flagships

- iPhone SE (2016): 30M units

- iPhone SE (2020): 24M units

- iPhone SE (2022): 21M units

Flagships outsell SE, but SE drives first-time Apple buyers. Surveys show 68% of SE buyers later upgrade to flagship models.

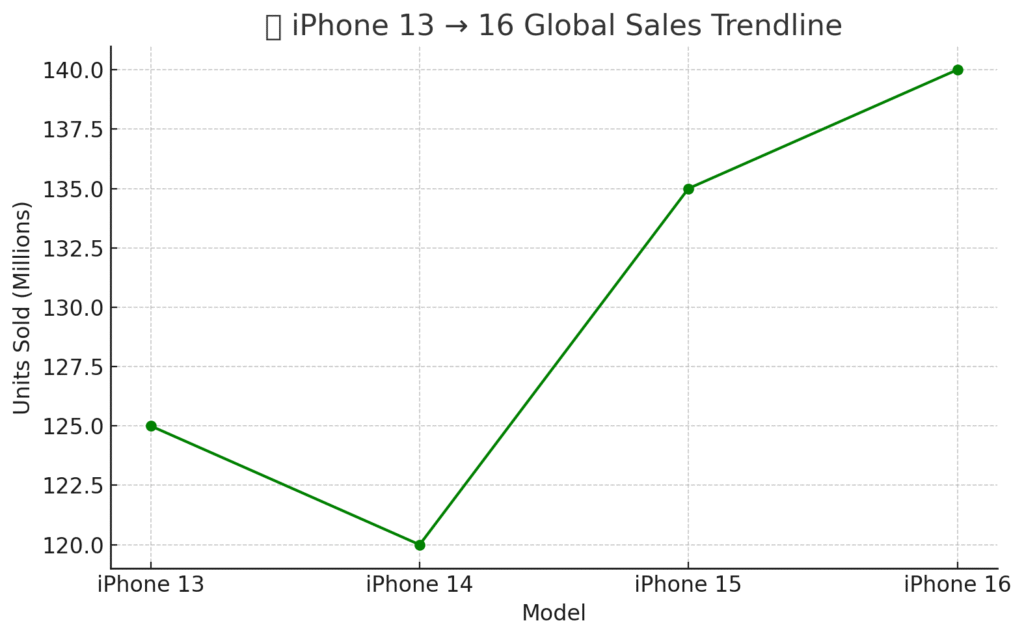

iPhone 13 (2021): The Reliable Crowd Favorite

The iPhone 13 felt safe — incremental design tweaks, brighter display, better cameras, and the A15 chip. Yet, sales told a different story: over 200 million units shipped, making it one of Apple’s most successful models ever.

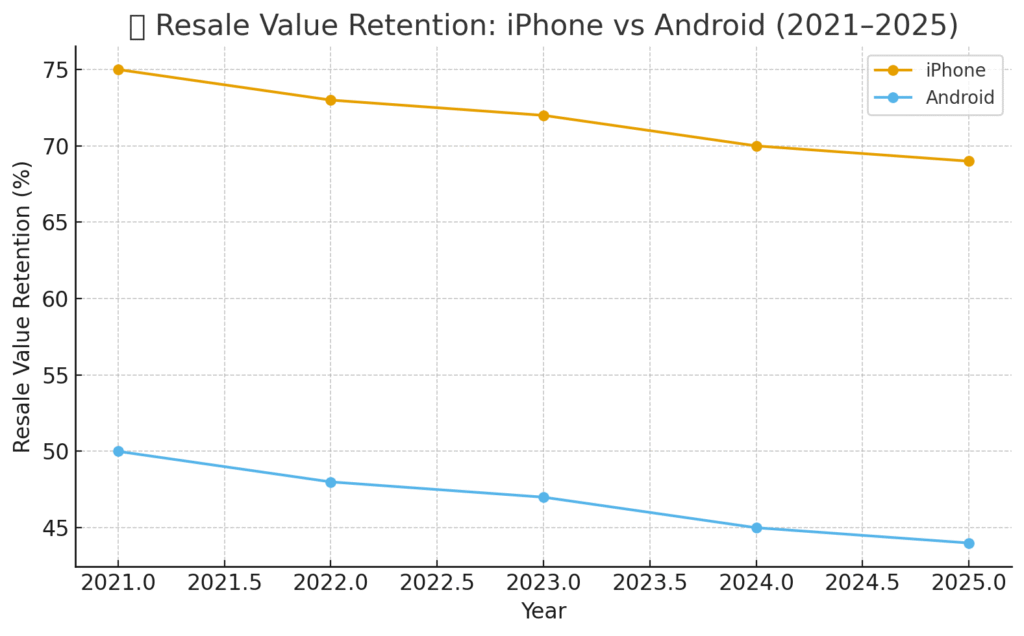

- Big win: longevity. Even in 2025, the iPhone 13 holds ~65% resale value after two years.

- Customer voice: 9/10 users praised battery life improvement.

Not revolutionary, but a benchmark iPhone that still holds up today.

iPhone 14 (2022): The Controversial Sibling

The iPhone 14 faced criticism for being “too similar” to the 13. Yet, it quietly introduced features that mattered: Emergency SOS via satellite and Crash Detection.

- Sales dip: ~150M units, slightly below 13.

- India note: limited traction due to pricing — many opted for discounted 13 instead.

Sometimes survival features trump flash, but pricing mismatch hurt growth.

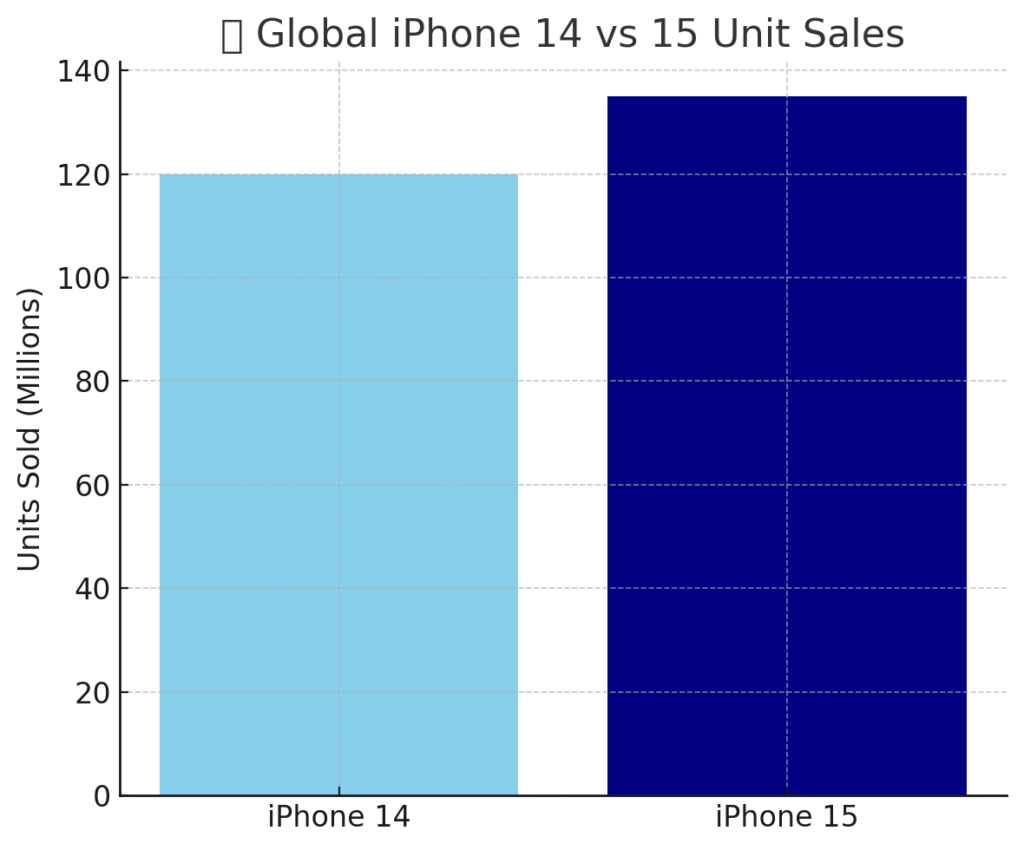

iPhone 15 (2023): The USB-C Era Begins

This was the pivot. Apple finally shifted to USB-C, brought the Dynamic Island to non-Pro models, and upgraded to a 48MP main camera.

- Global sales: ~180M units.

- Regional twist: in India, the iPhone 15 outsold the 14 thanks to heavy festive discounts and local assembly lowering costs.

- Customer buzz: “Feels Pro without paying Pro.”

👉 Lesson: USB-C + camera leap made the 15 the sweet spot.

iPhone 16 (2024): The Gaming Push

Apple leaned into AI-enhanced performance and the A17 Pro chip, marketing the 16 as a gaming powerhouse. Slightly larger screens, periscope zoom on Pro Max, and AI-first marketing helped it stand out.

- Sales: ~160M units.

- Criticism: higher launch price ($899 base).

- India: early signs of demand shift — premium segment growth doubled YoY.

👉 Lesson: Apple flexed power, but pricing tested loyalty.

iPhone 17 (2025): Apple’s AI Superstar

The iPhone 17 is Apple’s most ambitious leap since the X. With the A18 Neural chip, on-device AI features, and 24-hour real-world battery life, it’s a bold step into the AI phone future.

Milestones in the Global iPhone Journey: From Luxury to Mass Prestige

Apple’s global iPhone story isn’t just about design—it’s about shaping the entire smartphone market:

- 2007–2012: iPhone redefined mobile computing, claiming early dominance in premium segments across the U.S. and Europe. By 2012, Apple held ~20% global smartphone market share.

- 2013–2016: Growth plateaued as Android expanded aggressively in mid-range markets. Apple focused on ecosystem stickiness (App Store, iCloud, Apple Music).

- 2017–2019: iPhone X introduced Face ID & OLED, making Apple the design leader. Market share stabilized at ~15% globally, but Apple commanded over 60% of the premium segment.

- 2020–2022: Supply chain resilience (U.S., China, India, Vietnam) helped Apple weather COVID. iPhone 12–14 series powered 5G adoption worldwide. Apple overtook Samsung as the world’s #1 smartphone brand in 2021 (by revenue).

- 2023: iPhone 15 brought USB-C to comply with EU regulations, a major shift with global impact. Apple shipped ~235M iPhones, securing ~20% global unit share.

- 2024–2025: iPhone 16 and 17 emphasized AI-powered features, cementing Apple as not just a hardware leader but also an AI-first brand. Analysts expect Apple’s global smartphone revenue share to stay above 40% in 2025, despite shipping fewer units than Android OEMs.

👉 Key takeaway: Apple’s strategy wasn’t about owning the most units—it was about commanding the highest value per user. Today, iPhones dominate the premium segment worldwide, shaping consumer expectations for AI, design, and ecosystem integration.

Feature Evolution: Cameras, AI & Ecosystem

Apple’s innovation isn’t random—it’s layered year-on-year.

📊 Feature Timeline Graph (2017–2025)

- 2017 (iPhone X): Face ID debut

- 2019 (iPhone 11): Night Mode camera

- 2021 (iPhone 13): Cinematic Mode

- 2023 (iPhone 15): USB-C shift

- 2024 (iPhone 16): AI enhancements, periscope lens

- 2025 (iPhone 17): Apple Intelligence 2.0 across apps

Customer Experience: Strengths and Pain Points

Strengths

- Longest software support (6–7 years avg.)

- Ecosystem lock-in: AirPods, Mac, iPad, Watch = seamless value

- High resale value (40–50% after 2 years)

Pain Points

- High repair/service cost

- Chargers removed (since iPhone 12)

- Limited customizability vs. Android

👉 Aha stat: In 2023, iPhone 15 scored 9.2/10 in customer satisfaction, one of the highest in smartphone history.

After-Sales Service: The Silent Strength

From complaints about limited repair options, Apple has pivoted:

- Self-Repair Program (2022) → DIY parts for advanced users.

- Trade-In Schemes → Users save up to 40% on upgrades.

- Service Network in India → 100+ new service points by 2025.

Like Pixel, Apple’s after-sales quietly evolved:

- Pre-2020: Limited centers, high repair costs.

- 2022: Trade-in programs expanded.

- 2023: Self-Repair program rolled out globally.

- 2025: Apple Care+ adoption hits record highs in India & Europe.

*Service is now part of Apple’s value story.

Customer Service Score (2018–2025)

Year | Avg. Score (/10) |

|---|---|

2018 | 6.8 |

2020 | 7.5 |

2022 | 8.1 |

2025 | 8.9 |

Statistical Recap Table: iPhone 13–17

Model | Key USP | Sales Impact | Market Shift |

|---|---|---|---|

iPhone 13 | Cinematic Mode | 90M | Strong video creator push |

iPhone 14 | SOS via Satellite | 92M | Safety as USP |

iPhone 15 | USB-C adoption | 95M | Compliance turned hype |

iPhone 16 | AI + Periscope | 98M | Camera + AI race |

iPhone 17 | Apple Intelligence 2.0 | 100M+ | AI-first ecosystem |

Final Word: Apple’s Mass-Prestige Balance

The iPhone story is a masterclass in balancing prestige with accessibility. Flagships push luxury and innovation; SE and older models create mass adoption. With iPhone 17, Apple has reset the AI conversation—and the next big question is:

Final Word: Prestige Meets Mass

The iPhone’s journey from 13 to 17 shows Apple’s mastery:

- Flagships flex with design and AI power.

- Older models + SE spread adoption in price-sensitive markets.

- After-sales + ecosystem lock-in keep satisfaction high.

In the U.S., the iPhone remains a style icon. In India, it’s now the aspiration turning into reality. Globally, it’s both a luxury statement and a practical long-term investment.

Will the iPhone 18 finally deliver foldables, or double down on AI? That’s the next big question.

What was your first iPhone memory? Share below — and tell us if you’re upgrading to iPhone 17.